Ünlüsoy, Ömer Faruk

Loading...

Profile URL

Name Variants

Unlusoy, OF

Unlusoy, Oemer Faruk

Unlusoy, Omer Faruk

Unlusoy, Oemer Faruk

Unlusoy, Omer Faruk

Job Title

Arş. Gör.

Email Address

omerfaruk.unlusoy@agu.edu.tr

Main Affiliation

03.01. İşletme

Status

Current Staff

Website

ORCID ID

Scopus Author ID

Turkish CoHE Profile ID

Google Scholar ID

WoS Researcher ID

Sustainable Development Goals

4

QUALITY EDUCATION

0

Research Products

9

INDUSTRY, INNOVATION AND INFRASTRUCTURE

0

Research Products

14

LIFE BELOW WATER

0

Research Products

17

PARTNERSHIPS FOR THE GOALS

0

Research Products

Documents

2

Citations

1

h-index

1

Documents

1

Citations

1

Scholarly Output

3

Articles

2

Views / Downloads

11/0

Supervised MSc Theses

0

Supervised PhD Theses

0

WoS Citation Count

1

Scopus Citation Count

1

WoS h-index

1

Scopus h-index

1

Patents

0

Projects

0

WoS Citations per Publication

0.33

Scopus Citations per Publication

0.33

Open Access Source

1

Supervised Theses

0

Google Analytics Visitor Traffic

| Journal | Count |

|---|---|

| Corporate Governance-The International Journal of Business in Society | 1 |

| Kafkas Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi | 1 |

Current Page: 1 / 1

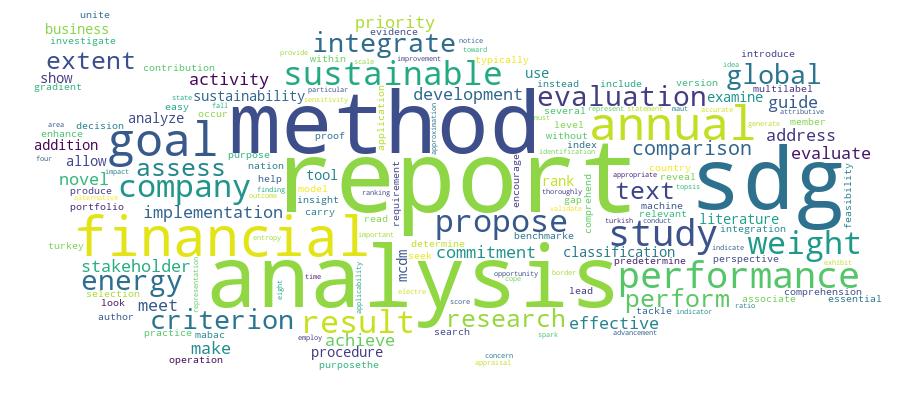

Competency Cloud